Does Insurance Cover Assisted Living?

What is Assisted Living?

Assisted living is a type of long-term care that allows individuals to remain in their own homes or apartments and receive help with activities of daily living such as meal preparation, personal hygiene, dressing, medication management, and transportation. It also provides other services, such as social, recreational, and physical activities. Assisted living can be a great alternative for those who want to maintain their independence.

Why Is It Important to Know if Insurance Covers Assisted Living?

Assisted living can be an expensive option and the associated costs can greatly impact a person's finances. It is therefore important to understand the various coverage options and determine if insurance can be used to offset some of those costs. Without insurance coverage, assisted living fees can be a significant financial burden.

Overview of Insurance Coverage and What it Can Cover

When thinking about whether insurance covers assisted living expenses, it's important to know the types of insurance that may be available to you. There are a variety of insurance policies that could help pay for some or all of your assisted living costs.

These include:

- Medicaid coverage

- Private long-term care insurance

- Medicare coverage

- Veteran’s benefits

- Other assistance programs

- Estate planning

Most insurance policies will provide coverage for some of the expenses associated with assisted living, like medication, equipment, supplies, and meals. Depending on the type of insurance you have, it may also cover transportation, personal care services, and skilled nursing services.

It's essential to be aware of your particular policy's coverage and limitations before making any decisions. Your policy might not cover all of your assisted living expenses, depending on the type of coverage you have and the amount of care you need. It's also important to find out if there are any additional costs that are not covered by your policy.

Medicaid Coverage & Eligibility Requirements

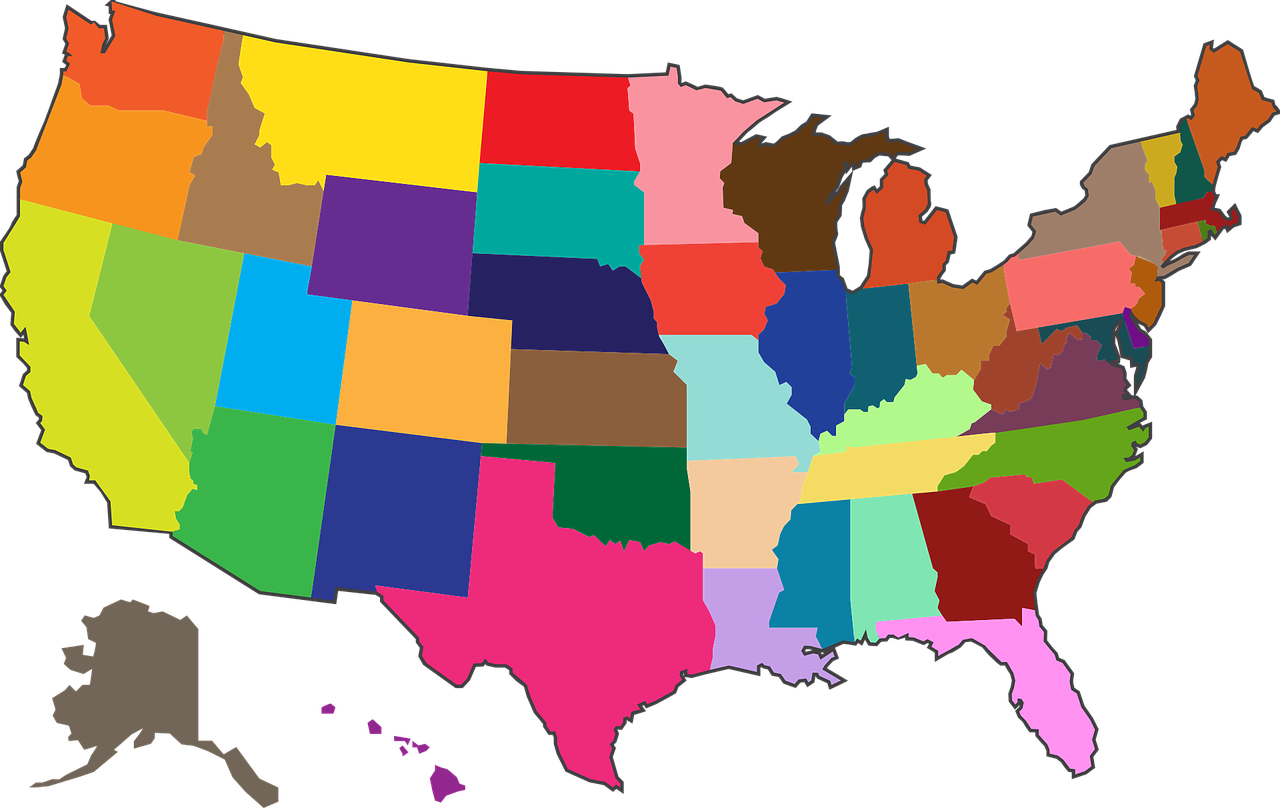

Medicaid is a health and long-term care insurance program funded by state and federal governments. It covers nursing home care, as well as other types of assisted living facilities such as adult daycare and family caregiver services. Medicaid regulations vary from state to state, so it’s important to research eligibility requirements in your state before applying.

In general, the eligibility requirements are based on two factors: your level of need and your financial resources. You must meet a certain level of need to qualify for benefits. This is determined by a combination of your age, health condition, medical diagnosis, and daily activity needs. Your financial resources will also be assessed to determine if you meet the financial qualifications. Specifically, you must have limited income and assets.

When you apply for Medicaid, you must submit documents that prove your eligibility. This could include proof of income, tax returns, bank statements, and proof of residency. Once your application is approved, you will receive a Medicaid card that is used to purchase coverage for specific services. Services covered through Medicaid may include nursing home stays, home health aides, respite care, and adult day care.

When it comes to assisted living, Medicaid typically covers room and board, caregivers, and medical equipment. It may also cover personal care services such as bathing, grooming, eating assistance, and more. To find out what services are covered in your state, contact your local Medicaid office.

Private Long-Term Care Insurance

If you’re looking for help with covering the high costs of assisted living, private long-term care insurance can be a great option. This type of insurance helps to offset costs related to assisted living, as well as other forms of long-term care, such as nursing homes and in-home assistance. Depending on the plan, it can help with some or all of the costs associated with assisted living.

There are a few different types of private long-term care insurance that you can look into. The most common ones are traditional long-term care insurance plans, which cover a variety of medical and personal care services. There are also newer hybrid plans that combine life insurance or annuities with long-term care benefits, offering a way to turn a portion of your savings into long-term care benefits.

It’s important to familiarize yourself with the insurance company’s guidelines before signing up for a policy. Most policies will have eligibility requirements related to age, health, and pre-existing conditions. It’s also important to understand the terms of coverage, including how much the policy will pay out, and what types of services it will cover. It’s best to speak with a licensed insurance advisor to get the most accurate and up-to-date information.

Private long-term care insurance can be a cost effective way to pay for assisted living, but it’s important to understand the nuances of the policies and make sure they fit your specific situation. Compare different insurers and coverage plans to make sure you find the best policy for you or your loved one’s needs.

Medicare Coverage and Reimbursement

When considering assisted living, it's important to look into your Medicare coverage. Medicare is a health insurance program for seniors and those with certain disabilities. It is administered through the federal government and provides coverage for medical and health-related services.

Medicare covers some assisted living services like home health aides, physical therapy, and occupational therapy. It also covers limited doctor visits and medical equipment needed in the facility. It does not cover personal care services or activities of daily living such as bathing, dressing, and housekeeping.

The best way to maximize your Medicare coverage is to be aware of what services are covered and research the various plans available in your area. You can find plan options at Medicare's website. Additionally, things like durable medical equipment may not be covered by Medicare but may be reimbursed by other insurance companies.

If you discover that Medicare does not cover certain services or treatments, you may want to consider other ways to pay for these expenses. You can ask family members for financial help or look into long-term care insurance policies. Additionally, some states have Medicaid assistance programs that can provide additional funding for assisted living expenses.

Veterans Benefits for Assisted Living

If you are a veteran in need of assisted living, there are many resources available to help you cover the costs. The Department of Veterans Affairs (VA) provides a variety of benefits to help veterans and their families pay for assisted living expenses. Understanding these benefits and how to access them can make a significant difference for veterans when it comes to affording quality care.

The VA offers two types of benefits for veterans seeking assisted living services: the Aid and Attendance program and the Housebound program. The Aid and Attendance program is provided through pension benefits and is designed to provide additional assistance to veterans who require regular help with activities of daily living, such as bathing and dressing. The Housebound program helps veterans who are confined to their homes due to disability or illness, and can assist with in-home care.

In addition to VA benefits, many states also offer a range of programs and services to help veterans with assisted living expenses. These benefits may include financial support for long-term care, temporary respite care, nursing home care, and other supports. To find out what programs are available in your state, contact your nearest VA office.

It's important to note that not all VA benefits will cover all assisted living expenses. For example, the Aid and Attendance program does not cover room and board, while the Housebound program does not cover personal care services. Be sure to check with a VA representative to understand what type of coverage you may be eligible for, and any restrictions that may apply.

Other Assistance Programs

When determining how to cover the costs of assisted living, there are other possible resources that you may not have considered. Some charitable organizations provide assistance for individuals seeking help with assisted living. Subsidized units, in which rent is reduced to meet the needs of the resident, may be available in some states. Additionally, there are government-funded supports, such as Medicaid, Medicare, or Veterans Benefits, that can help with assisted living expenses.

Charitable organizations provide aid for individuals that qualify for assistance. Different organizations have different criteria and application processes, so it is important to research options thoroughly before making a decision. Some organizations, such as The Salvation Army, may offer grants to qualifying individuals in order to help pay for care.

Subsidized units are another possible option when looking for help with assisted living. In these cases, the individual secures housing through a private landlord who agrees to reduce the rent to a rate more suitable to the resident's income. This can provide a significant cost savings, but availability of subsidized units depends on state and local regulations.

Finally, government-funded programs, such as Medicaid, Medicare, and Veterans Benefits, can help cover costs associated with assisted living. Each of these programs offers different types of assistance, but all can provide some financial relief when you need it.

Estate Planning and Assisted Living Expenses

When it comes to planning for your future, it's important to think about how you will cover any expenses associated with assisted living. Estate planning can be an invaluable tool in making sure that you – or your loved one – are financially secure and able to get the care they need. Here we'll lay out some tips on how to plan for the financial responsibility that comes with assisted living.

Understand Your Existing Assets

The first step is to understand what assets you already have and what resources are available. This includes things like investments, savings accounts, and home equity. Knowing these figures can help you determine how much money you have available to be used for assisted living expenses.

Create a Budget

Once you know your existing assets, it's important to create a budget. This will let you know how much money you can allocate to assisted living costs. Be sure to factor in the amount you can safely withdraw from any investment accounts, as well as the money you can get from selling or renting your home. This will give you a more accurate picture of your total funds available for long-term care.

Think About Insurance Plans

It's also important to consider insurance plans. There are a variety of plans available that may help cover part or all of the cost of assisted living. Explore your options and determine which plans may be beneficial. Many plans require pre-approval, so it's important to start looking into these options as early as possible.

Discuss Your Options With A Financial Professional

Finally, it's essential to speak with a financial professional about your estate planning needs. They will be able to provide advice and guidance on how to best plan for assisted living expenses. They can also help you determine the best way to use your existing assets to ensure you have enough money for long-term care.

Estate planning is an important aspect of preparing for assisted living. Taking the time to understand your current financial situation and plan for the future can help you ensure that you or your loved one is able to receive the care they need without having to worry about the financial burden.

Conclusion

Assisted living can be a necessary and life-altering decision for many families. It is important to know what types of insurance and other benefits may be available to help cover costs. Medicare, Veterans Benefits, and private long-term care insurance are possible sources of assistance though their coverage varies significantly. To supplement insurance coverage, there are other government and state funded programs, charitable organizations, and estate planning that may help to reduce the financial burden of assisted living.

We hope this guide has been informative in helping you understand if insurance covers assisted living. If you have any additional questions or require more information, please reach out to us and we'll be happy to help.

Resources

When researching assisted living and insurance coverage, it's important to have reliable sources of information. Here are a few of our favorite resources which can help you with your research.

- The National Care Planning Council provides resources about the costs of assisted living and insurance coverage. They also have state-specific information and tools to help you create a budget for care.

- The Family Caregiver Alliance offers an online library with articles and fact sheets about assisted living and coverage options.

- The Department of Health & Human Services provides a guide to Medicaid and Medicare coverage for assisted living. It also includes details about specific state programs.

Glossary of Terms

When considering assisted living facilities, there are a variety of legal and insurance terms to be aware of. Here's a brief glossary of terms to help you understand the terminology surrounding assisted living and insurance coverage:

- Assisted Living: A type of residential care facility which provides care to seniors who need assistance with daily activities, such as meals, dressing, bathing, and medication management.

- Long-term Care Insurance: An insurance policy designed to cover the cost of long-term care, such as nursing homes, assisted living facilities, home health care, and hospice care.

- Medicaid: A joint federal and state program that provides health coverage for certain individuals and families with limited incomes and resources.

- Medicare: A federal health insurance program that pays for hospital, medical, and some home health care services for people age 65 or older, and certain other individuals.

- Subsidized Unit: An assisted living residence in which all or part of the rent is subsidized by the government or other charitable organization.

- Estate Planning: A process of developing a plan for the management and disposal of a person’s assets during their lifetime and after death.

Appendix: Estimated Assisted Living Costs

The cost of assisted living varies depending on the type of facility and services offered. Here is a chart of estimated costs for various types of facilities:

- Independent living (no care services): $2,000-$4,000/month

- Assisted living: $3,500-$6,500/month

- Memory care: $4,000-$7,000/month

- Nursing home: $5,000-$8,000/month

It's important to review costs specific to the facility of interest and understand what services are included in the monthly fee.

You might also like this article: